Awareness research and results

What is deposit insurance awareness?

At CDIC, we work to ensure a high number of depositors are aware of deposit protection in Canada.

Our goal is to have 60-65% of depositors aware of CDIC or federal deposit protection. We measure our results against the goal with a quarterly survey of 2,000 respondents across Canada.

Why is awareness important?

Our research shows that high levels of awareness contribute to:

- Overall confidence in the financial system

- Confidence in CDIC’s ability to protect deposits

- The stability of the financial system

- Reduced bank run behaviour

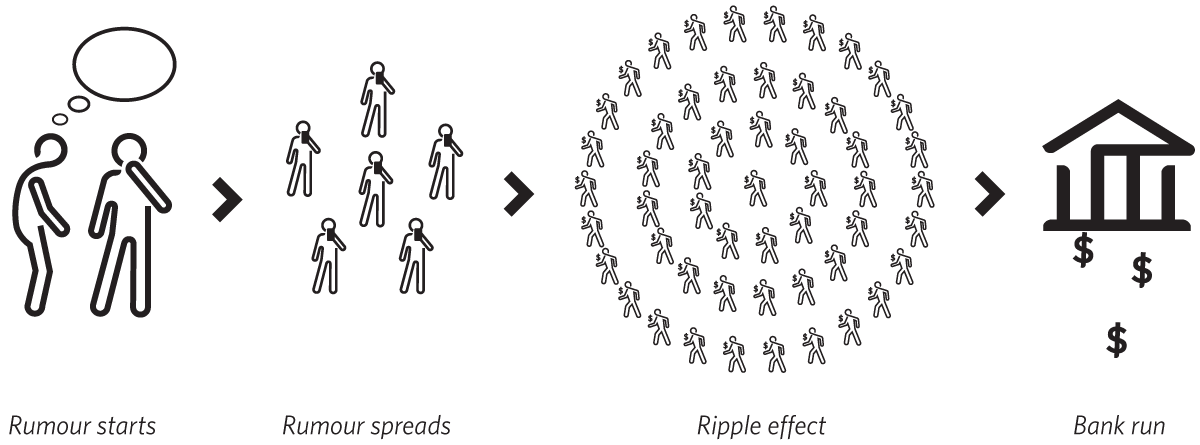

What is a bank run?

A bank run happens when many customers withdraw their deposits from their bank or financial institution at once. They are rare, but they can impact the economy.

A bank run may start like this:

How we reach out

CDIC research shows us what groups have lower awareness, so we aim our advertising there. Our efforts help reduce the risk of run behaviour. We do so by using many platforms to get the most reach with our message.

Current awareness level among Canadians

55% of women

are aware of CDIC.

74% of men

are aware of CDIC.

65% of Canadians

are aware of CDIC.

Awareness by age group

| Age group | All | Men | Women |

|---|---|---|---|

| 18-34 | 53% | 64% | 42% |

| 35-49 | 60% | 71% | 49% |

| 50-64 | 71% | 80% | 63% |

| 65+ | 76% | 85% | 69% |

Awareness by region

| Region | All | Men | Women |

|---|---|---|---|

| Atlantic | 65% | 78% | 53% |

| Quebec | 55% | 65% | 46% |

| Ontario | 68% | 78% | 58% |

| Prairies | 63% | 72% | 55% |

| Alberta | 67% | 76% | 59% |

| British Columbia | 70% | 80% | 60% |

Awareness by first official language

| First official language | All | Men | Women |

|---|---|---|---|

| English | 67% | 77% | 58% |

| French | 54% | 63% | 44% |

* data as of June 2024