Payment Service Providers (PSPs) registered under the Retail Payment Activities Act (RPAA)

The Retail Payment Activities Act (RPAA) requires a payment service provider that performs a retail payment activity of holding end-user funds, to hold these funds in one of the two following ways until the end-user withdraws them or transfers them to someone else:

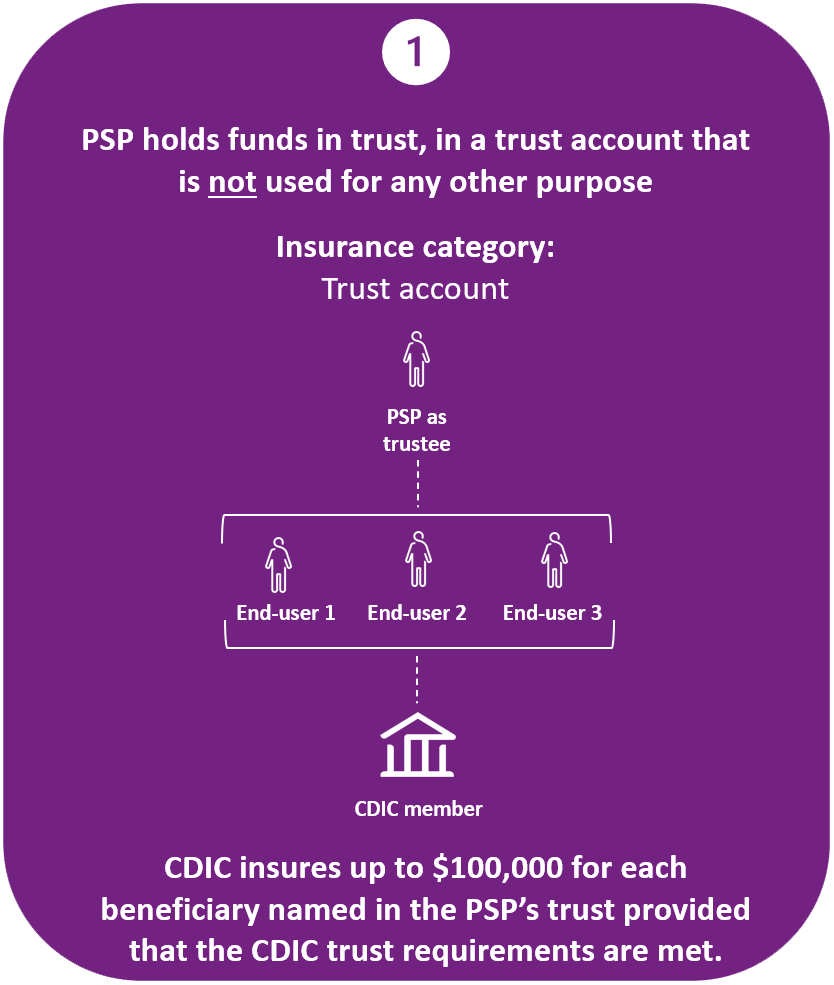

- In trust, in a trust account that is not used for any other purpose; or

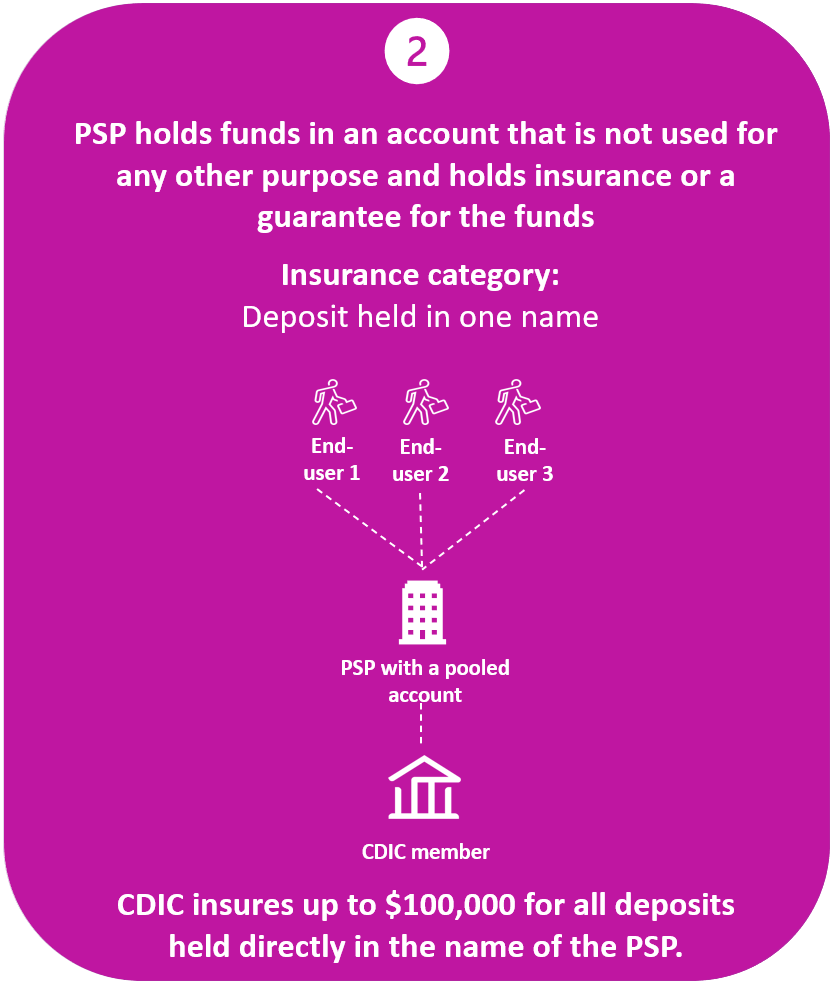

- In an account that is not used for any other purpose and hold insurance or a guarantee in respect of the funds that is an amount equal to or greater than the amount held in the account.

The option chosen will have an implication on availability of CDIC deposit insurance (against failure of the CDIC member) if the payment service provider holds the funds with a CDIC member.

For more information on retail payments supervision, please visit the Bank of Canada website.

CDIC Coverage Application

Payment service providers that are subject to the RPAA are not CDIC member institutions, but they may hold end-user funds with CDIC member institutions. CDIC provides deposit insurance for the funds held at its member institutions if one of those member institutions were to fail. CDIC deposit insurance does not protect end-user funds if the payment service provider fails.

If a payment service provider holds funds in a CDIC member institution, coverage can apply in the following ways:

For more info about how CDIC coverage could apply to PSPs, consult our guide.

Amendments to the CDIC Act to allow PSPs to qualify as professional trustees

On September 8, 2025, PSPs who are registered as such by the Bank of Canada will be eligible to be professional trustees under the CDIC Act. This would apply where a registered PSP acts as a trustee and holds end-user funds in trust, in a trust account. As a result, they can benefit from lighter beneficiary reporting requirements (see Professional Trustee Data Requirements link below).

If a registered PSP chooses to designate its trust account as a professional trustee account, they can start preparations before September 8, 2025. However, the CDIC member will not be able to flag their accounts as professional trustee accounts before September 8, 2025. Before that date, they will be subject to the regular trustee rules and requirements.

For more information about the professional trustee framework and related requirements, visit the professional trustee page.

Importance of proper disclosure

It is important that depositors have clear, accurate, easily accessible and timely disclosure about CDIC protection so they can make informed financial decisions about the safety of their deposits.

Section 2 of CDIC’s Deposit Insurance Information By-Law states that no person shall make any false, misleading or deceptive representation with respect to:

- what constitutes, or does not constitute, a deposit

- what constitutes, or does not constitute, a deposit that is insured by the Corporation, or

- who is a member institution

Payment service providers should be prepared to answer the following questions from clients:

- Is my money held by a CDIC member?

- Is my money eligible for CDIC protection?

- How much of my money is protected by CDIC?

CDIC has developed a training tool to help you respond to end-users’ questions about CDIC protection. The tool is made up of self-directed, interactive, gamified learning modules that are short and take no more than five to seven minutes to complete.

If you have any questions about how CDIC coverage may be applicable to the business arrangement you have, or about deposit insurance disclosure requirements, contact us at:

-

Email

members@cdic.ca