Fintechs

A fintech, short for financial technology, is a company that uses technology, like online platforms and mobile apps, to provide financial services to customers. Most fintechs don’t have physical locations and usually interact with customers online.

Fintechs can offer products like prepaid cards, savings accounts, and other products much like banks. But unlike traditional banks or credit unions, these companies don’t have banking licences, are not CDIC members and are not insured by the CDIC.

CDIC deposit protection may apply to eligible deposits managed by fintechs, depending on how and where the funds are kept. As more fintechs emerge, it might be unclear if your money is eligible for CDIC protection. We’re here to explain it.

How CDIC protection works

CDIC insures eligible deposits held at member institutions. Because fintechs are not members, we do not protect your funds held by a fintech unless they place them as eligible deposits with a CDIC member institution. Even then, they must be in an account in your name or in a trust account where you are named as beneficiary. Only then are those funds eligible for CDIC protection against the failure of the member institution that holds your funds.

Let’s explore the two ways a fintech can deposit your money at a CDIC member so that your money is eligible for CDIC protection and a way that it is not.

➔ Select the icon that best describes your situation to understand how coverage works (or doesn’t) in these different cases.

The fintech places your money in an account under your name at a member institution.

In this case, the bank’s records will show you as the official account holder.

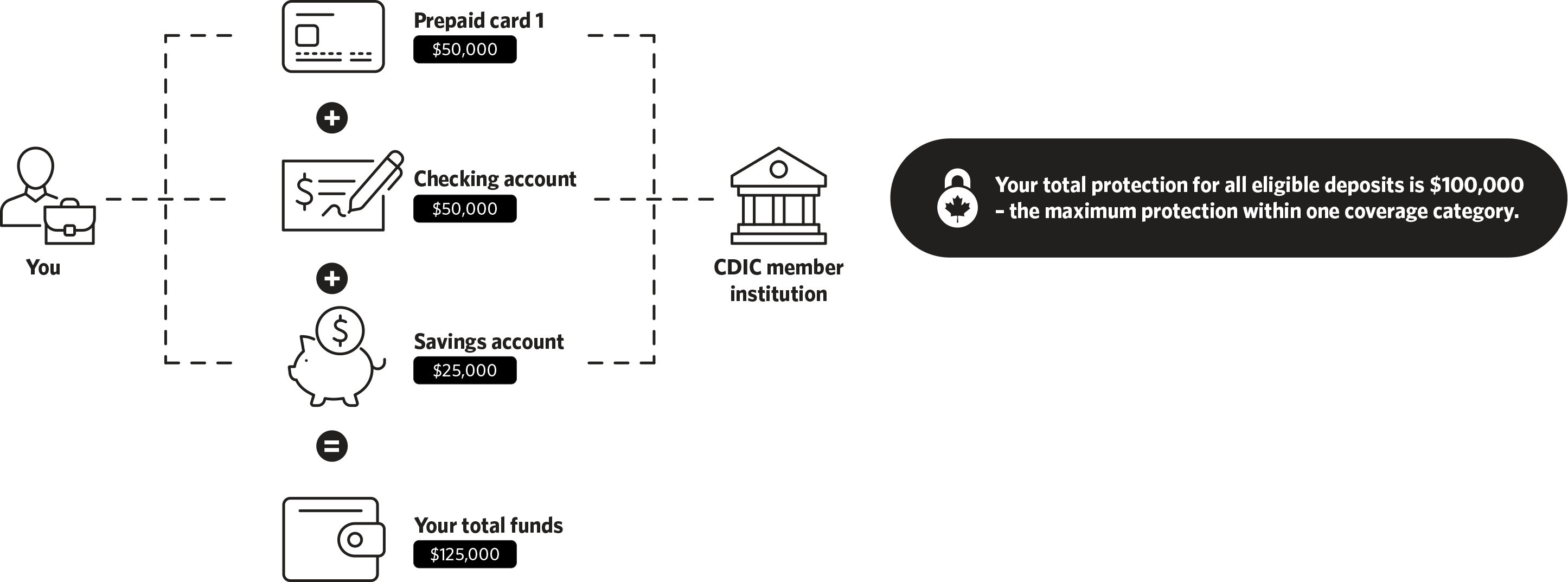

CDIC coverage can apply to this account, just like if you deposited the funds into the CDIC member yourself. We combine these funds with any other eligible deposits you have in that insurance category at that same member institution for a total of $100,000.

What happens if the fintech fails?

If the fintech fails, your money is not affected because you are the owner of the account at the CDIC member institution. Since the account is held in your name, it is not part of the fintech’s assets and won’t be used to pay any of its creditors. To access your funds, you must know what bank holds them. If you’re not sure where the account is held, contact your fintech.

What happens if the bank fails?

If the bank fails, your funds are protected by CDIC, and you will be automatically covered. We treat this deposit the same way as deposits made by you directly with the bank. CDIC combines the funds in this account with other deposits that you might have at this bank in the same insurance category for a total coverage of up to $100,000.

The fintech deposits your money in trust at a member institution and names you as a beneficiary.

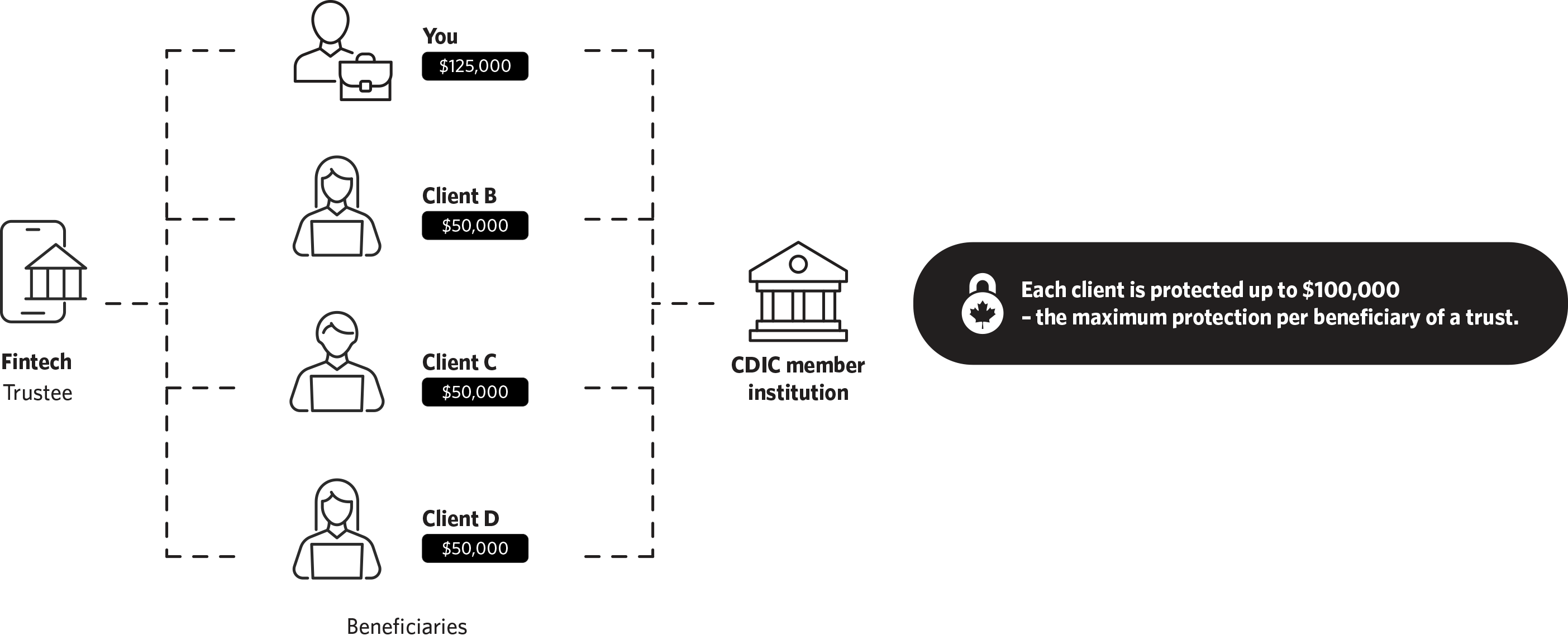

In this case, the bank’s records will show the fintech as the trustee and you and other clients as the beneficiaries of the trust account. CDIC protection on trust accounts applies to each beneficiary up to $100,000 of eligible deposits.

Here are the conditions for your funds to benefit from CDIC protection for up to $100,000 within that account under this arrangement:

- The fintech (the trustee) asks the member institution to designate the account as a trust account and provides its name and address.

- The fintech (as the trustee) provides the name, address and amount owed to each beneficiary (i.e. you and other clients of the fintech) to the CDIC member. If the account is designated as a professional trustee account, this information is provided directly to CDIC. In the event of a member institutions failure, CDIC can then calculate the amount of insured deposits that it needs to reimburse depositors.

To learn more, see our Professional trustees page.

What happens if the fintech fails?

CDIC would not play a role in this process. The fintech will be subject to a conventional bankruptcy and liquidation process, but in this example your funds will stay in trust at the member institution where they were deposited.

What happens if the bank fails?

CDIC will insure the money in the trust account up to $100,000 per beneficiary named in the trust. The coverage of the trust account will not affect other eligible deposits you might have at this bank.

CDIC manages the failure of member institutions. We use the information on the bank’s records to start the reimbursement process. If the fintech designated the account as a professional trustee account, the fintech will need to send us your name, address and amount owed to you so we can calculate the amount of insured deposits. CDIC will only be able to reimburse the insured deposits when the fintech sends us the required information.

Your eligible deposits are reimbursed to the Fintech (the trustee) who is the depositor on record on behalf of their beneficiaries (i.e. you and other clients). Then the fintech decides the best way for you to access your funds. For example, they can recommend that you place it in a different institution or return it to you. CDIC will return any other eligible deposits you have at that bank to you in the form of a cheque.

When you’re not covered – the fintech places your money in an account in the fintech’s name.

In this case, the bank’s records will show the fintech as the official account holder. This account is also called a ‘pooled’ account, where funds from other clients are combined in the same account.

What happens if the fintech fails?

CDIC would not play a role in this process. The fintech will undergo a conventional bankruptcy and liquidation process.

What happens if the bank fails?

CDIC will insure the pooled account up to a total of $100,000. However, because the account is in the fintech’s name, the fintech is considered the sole depositor. In this case, CDIC’s coverage only applies to the fintech and not their clients. The pooled account is combined with other eligible deposits the fintech has in the same deposit insurance category at that bank and is insured up to a total of $100,000.

What to ask your fintech

To better understand how CDIC might apply to your fintech product, start by asking these questions:

- Is my money held by a CDIC member?

- How is my money placed at the CDIC member?

- How much of my money is protected by CDIC?

CDIC’s Deposit Insurance Information By-Law prohibits any person from making false, misleading or deceptive claims about being a CDIC member or what is protected by CDIC.

Fintechs are expected to comply with this requirement and CDIC is continuously working with major Canadian fintechs that engage with CDIC members to help them understand CDIC’s disclosure rules and how to answer client questions about deposit insurance coverage.

Good to know

If you suspect that a financial technology company is misrepresenting the CDIC protection that is available to their clients, please contact CDIC at info@cdic.ca.

Learn about products commonly offered by fintechs (like prepaid cards)